Indo-Japanese Ties Set to Boost Indian Semiconductor Patents and Technology Collaboration

Due to the importance of semiconductors to the modern global economy, the sector earned US$574.1 billion in sales in 2022 and is still increasing, employing many people at all phases of development, from design to global distribution. The continuous growth of the semiconductor industry is expected to drive further advancements in patents and technology collaboration, propelling it to new heights.

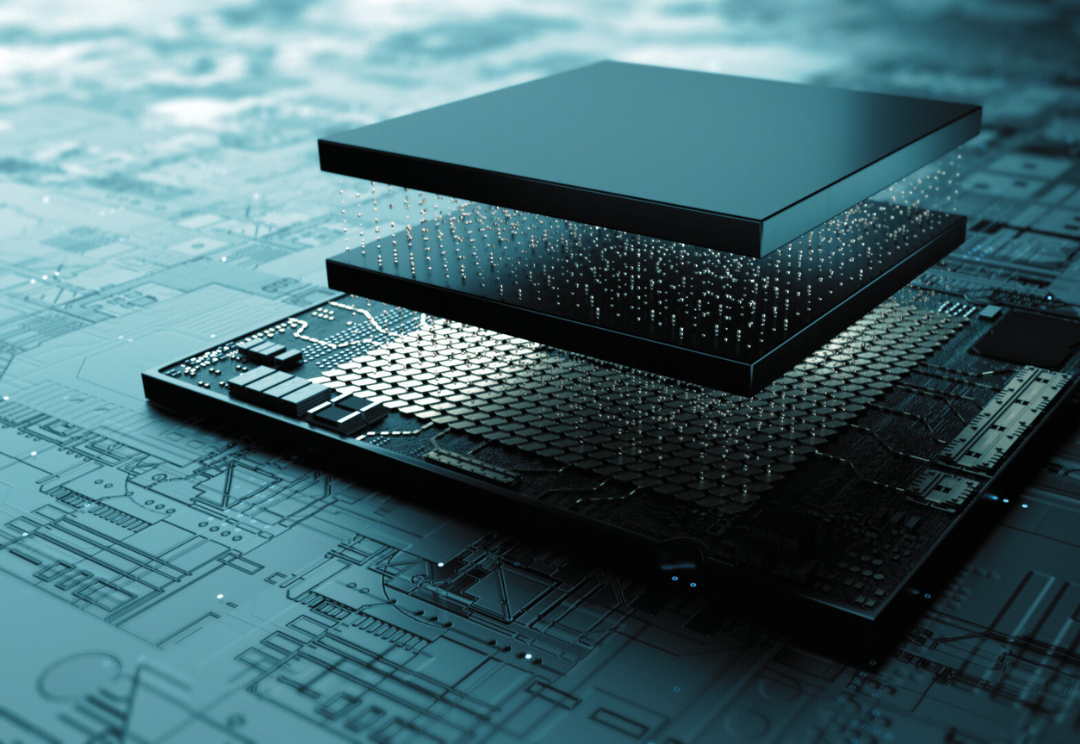

It developed into a crucial area of the economy for many countries, with numerous governments and businesses making significant investments, competing, and working together on research and development projects to stay ahead of the curve in terms of innovation and to retain competitiveness. The supply chain for chips moves from design and development to manufacturing, testing, assembly, and delivery. Many countries are attentively monitoring any disturbance to their supply chain to prevent mishaps by any nation. Any disruption to the system should be taken seriously, as was the case during the COVID-19 outbreak. It is crucial to have a resilient and adaptable supply chain that can withstand unforeseen challenges.

In response to China's increasing influence in the semiconductor supply chain and the growing significance of semiconductors in tech-geopolitics, Japan and India signed the "Japan-India Semiconductors Supply Chain Partnership" Memorandum of Cooperation (MoC) in July 2023 to deepen their supply chain collaboration. The agreement will center on talent development, manufacturing, R&D, and design for the semiconductor industry. Japan's Ministry of Economy, Trade, and Industry and the IT Ministry first signed the Memorandum of Understanding in July of this year.

The Indo-Japanese relationship has depth because both countries have demonstrated over time that they are committed to global issues. Their cooperation spans cultural exchanges, scientific and technological collaboration, economic cooperation, military force interaction, and more.

A seamless semiconductor supply chain is essential given the scale, function, and wide range of applications—including use in military hardware.

The signing of the Memorandum of Understanding (MoC) between Japan and India is viewed as an important and strategic step. Given that China's increasingly forceful and disruptive actions are perceived as a danger by both countries, the India-Japan Special Strategic and Global Partnership serves as the clearest definition of a strong bilateral partnership.

In this case, the Memorandum of Understanding (MoC) that India and Japan signed intends to fight China by working together to expand the chip business. The discovery and use of materials like graphene, quantum computing, and photonic circuits will advance the application of semiconductors in the upcoming years. Semiconductors are still widely used and essential to the tech industry. To strengthen the robustness of the semiconductor supply chain, the partnership fosters industry-to-industry and government-to-government collaboration as it attempts to address these issues.

Given that the semiconductor market is expected to reach US$1 trillion in revenue by 2030, McKinsey projects that industry growth will average between 6 and 8% annually through 2030. Consequently, industry volatility is expected to have an impact on the US-China trade war, placing other countries in an unfavorable position. This could potentially lead to shifts in global trade dynamics and relationships.

Electronic companies are attempting to diversify their supply chain and are keeping an eye on India due to US-China techno-geopolitics. Since India wants to grow its semiconductor industry, secure a spot in its supply chain, and become a US$1 trillion electronic market, it requires solid and trustworthy tech ties with other like-minded countries.

India's ambitions and the semiconductor industry's growth are aligning, so it is necessary to consolidate and safeguard India's MoC with the US and Japan. India is working hard under the MoC to develop a robust semiconductor sector, and working with Japan is crucial to this goal. They will collaborate in talent development, equipment research, design, manufacture, and supply. India contends that the collaboration with Japan underscores the international community's growing faith in India's ability to develop a full semiconductor ecosystem within the nation, given the country's rapidly advancing semiconductor mission.

The signing of the MoC is a crucial step in the bilateral cooperation between India and Japan in the field of science and technology. With India expanding its electronic markets, increasing its role in the global semiconductor supply chain, advancing its digital economy, and strengthening its R&D capabilities, the partnership was seen as a calculated move that would help them capitalize on their complementary skills.

Foreign companies are finding it more difficult and uncomfortable to operate in China due to rising labor costs and the 2021 data security law. As a result, they are searching for alternative locations to invest in and manufacture in. But the MoC shows how multinational companies are reorganizing their supply chains in the wake of the pandemic. For the next five years, it will be in effect, enabling Japan to capitalize on its strengths in the manufacturing of silicon wafers and ingots, raw materials like gases, display, and equipment, and India to use its excellent human resources in fields like semiconductor design.

Many experts contend that China won't be in immediate danger from the expansion of India's semiconductor industry because it is a significant player in the industry and because the world still depends on China's abilities and strengths. This is true even as the manufacturing base is shifting from China to many other countries, including India. China's unwelcoming business practices and policies, combined with a challenging business climate regarding India's Made in India policy, have encouraged foreign businesses and governments to work with India and the MoC. This is indicative of India's increasing significance in the global business and manufacturing landscape.

With a focus on five areas—design, manufacturing, equipment research, talent development, and enhancing supply chain resilience for semiconductors—the Ministry of Communications and Information Technology in India is striving to establish an environment that is favorable to the country's electronics manufacturing sector.

Japan will spend US$35.9 billion in India by 2027, as per the MoC, and this kind of cooperation may soon lead to increased cooperation in defense technology and equipment. Micron Technology invests US$2.75 billion to establish a semiconductor unit in India, while Applied Materials contributes US$400 million to establish a cooperative research and development center. India offered a $10 billion financial incentive in exchange for paying for half of the project's expenses to be incurred there.

Japan is seen as a natural partner and has played a noteworthy role in many of India's ambitious initiatives, including high-speed rail, Maruti, Metro, and emerging and key technologies, according to India's Foreign Minister, S. Jaishankar. The US and Japan's MoC with India indicates that these countries are interested in and focused on assisting Indian sectors, including working with India, notwithstanding Foxconn's departure from the US$19.5 billion agreement with Vedanta for the semiconductor joint venture.

The Indian government approved the MoC on October 25, 2023. Japan's ambassador to India, Hiroshi Suzuki, welcomed the approval and described it as a major milestone that will boost Indo-Japanese ties and encourage G2G and B2B cooperation with a robust chip supply chain. Furthermore, the Prime Minister of India, Narendra Modi, has praised the action and stated that it will fortify the chip supply chain, expand bilateral collaboration in the electronic ecosystem, and provide new job possibilities in the IT sector.